There are so many recent instances of NPAs which have been brought to our notice by the media recently. Loan frauds seem to be the order of the day in many such cases.

The typical modus operandi in such cases is:

Mr. X takes a huge loan of hundreds of crores of rupees from Bank “A”, and takes another loan from Bank “B” without disclosing information on previously existing loans. In many cases, help is received from within the bank and involves money changing hands! The scammer then typically decides to take himself to a foreign country where he can’t be held responsible for committing fraud and the scam makes top headlines during an audit from concerned regulatory bodies. But it’s too late by then.

A Blockchain network adds a much required positive twist to the story

Now suppose the government brings all Lender Banks and Regulatory bodies on to a single Blockchain network. A Mr. Y takes a loan of hundreds of crores of rupees from Bank “A”, once his application gets approved all the participants of the network have access to a copy of this approval.

Mr. Y then goes to Bank “B” and tries to take another loan without disclosure. Bank “B” however, can check his loan history on Blockchain and can reject his application for an additional loan. If they still for some reason do decide to lend to this individual or try to personally benefit from the deal – which is near to impossible thanks to immutable nature of transactions on Blockchain – on approval, regulatory authorities are in a position to identify a fraud in progress and take necessary action on an immediate basis.

Which is why, the Indian government has implemented a live blockchain network for the MSME sector. You can read more about this development here:

An Excerpt from the article:

“A trio of Indian government-sanctioned companies built a blockchain network to ensure that if a borrower obtains a loan via one of them, the other two will be notified to avoid duplicate lending. It’s part of an exchange platform they created to bring lenders together with borrowers. The group built their blockchain network using the Linux Foundation’s open source Hyperledger Fabric.”

You can read a little more on the same story covered by the Hindu Business Line here:

Excerpt from the article:

“The financial exchange system provides a common platform not controlled by any one financial institution to share information, which reduces fraud. The Reserve Bank of India licensed the three private companies to create the platform to facilitate small business loans. The three exchanges are RXIL, A.TReDS, and M1xhange. These exchanges count some of the biggest Indian banks and a number of foreign banks as funding sources. The companies hired MonetaGo to help them build the blockchain element of the platform.”

However, Blockchain is a fairly new development or rather a digital disruption in its nascent stage. To understand it a little better, let’s start from the beginning:

What is a Blockchain?

In simple terms, it’s a chain of blocks comprising of transactions which can be used to know the complete history of an asset. An asset could be anything from currency to land deeds, personal details, shipment details, product details (it can vary as per the context and industry). Each block will have a hash-code of the previous block and so it forms a chain. Only the participating organizations/ people can access this network. Data immutability (once written can’t be changed) and non-repudiation (assurance that someone cannot deny development or addition) makes it more secure and trustworthy.

To write a transaction on such a network, the writer node is decided via a consensus. In the case of Bitcoin, nodes have to solve a mathematical puzzle. Whichever node solves it first, gets a chance to write the transaction on the blockchain network and monetary rewards of course are strong motivation to compete. This way the data becomes more trustworthy and corruption is mitigated sufficiently.

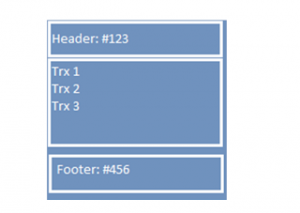

Every block has a header, content and footer.

The Header has the hash-code of previous block all the way to the hash-code of the Genesis block.

The Content section has the actual payload, or can have a hash-code of the root of the underlying Merkle tree.

The Footer has the calculated hash-code of the complete block including the hash-code of previous block.

Note: Here the #456 is calculated by taking account of #123 + Trx1+Trx2… Etc.

Now if someone updates even a single bit of content in any of the previous block, hash-codes of all the blocks starting from that block till the latest blocks will be recalculated, and everyone on the network can identify the exact instance and place of the modification.

Why is there so much of a hype around this concept?

The major threat to any asset is the breach of its secrecy, and once compromised, it can create havoc. To stop such incidents, companies are looking to invest heavily in data security. But the most common approach is have all the data stored in a central repository. Once compromised this repository allows access to the entire data network and can lead to organizations losing their competitive advantage, revenue streams and their reputation, all in an instant. Also, auditing such a repository is an expensive task in terms of time & money.

With advent of blockchain, the data is stored on participating nodes which don’t necessarily have to be in the same geographical location. If one tries to hack into such a system they have to simultaneously attack all the nodes in the shortest time frame. This makes it nearly impossible to hack and perhaps serves as one of the biggest advantages of the blockchain technology. In case of a natural calamity or breach in one location, the data can be restored from any of the other nodes.

The Technology

Distributed Ledger Technology (DLT) is at the core of blockchain. Instead of storing data centrally and securing it with firewall and other measures. With DLT the network nodes takes the responsibility of storing latest copy of the data or the ledger – record of transactions in encrypted form.

The data is stored and synced based on the consensus algorithm. This algorithm first checks for the hash codes of all the previous blocks to identify the node with the access to write transactions on Blockchain.

These networks are governed by a binding contract known as smart-contract which all parties have agreed upon while joining the network and is based on either Ethereum or Chaincode or Hyperledger-Fabric. One such example could be a smart-contract among all banks and regulatory bodies, to disallow scammers such as Mr X or Y from taking multiple loans.

Types of Blockchain networks which you can use / create depending on the need:

Pros & Cons

Pros:

Cons:

So, that’s blockchain in a nutshell but before you get too excited about replacing your existing architecture with blockchain you need to ask yourself certain questions:

If the answer to any of these questions is NO, blockchain is probably not for you. Blockchain is a lot more disruptive than the internet was and it’s no wonder that everyone wants to jump onto the bandwagon but it’s not really the universal answer to all of your tech issues. Assess your business needs thoroughly before you decide to get blockchained!